Bangladesh Petroleum Corporation is perhaps the biggest public entity that has the largest turnover and receives huge amount of subsidy every year.This time I tried to take a look at the BPC profit/loss between 2001 and 2018. I also probed how the oil price, crude oil spending, diesel and other petroleum spending and dollar-Taka exchange rate shaped the annual BPC loss /profit in the given period.

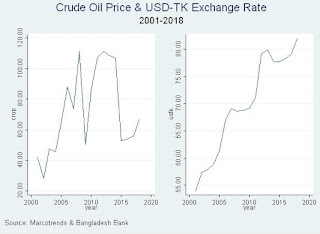

During the period the oil price fluctuated , hitting the nadir of $28.17 /barrel to reaching the apex of $111.29/barrel. Meanwhile, Taka depreciated gradually over the period.

Between 2011 and 2014, when the oil price in the international market was sold on average above $105/ barrel, BPC's annual loss also reached its peak. In this period , BPC made an annual loss of Tk 7184.25 crore on average. It made the highest loss Tk 11790 crore in 2012. To make up those losses it heavily hinged on government subsidy. According to a study by Policy Research Institute,energy subsidies reached 1.1% of GDP in 2012-2013. During the same period, its annual subsidy on average was Tk 7146.36 crore. In this period it received the highest subsidy of Tk 13557.83 crore in 2013. From 2014 onward, oil price fell below $50 / barrel and BPC made profit since then. Between 2016 and 2018, it did not receive any subsidy from the government. In addition, it reached break even stage in December 2018, as widely reported by the press. It reported a profit of Tk 5268 crore in 2015, Tk 6342 crore in 2016, Tk 4399 crore in 2017 and Tk 3995 crore in 2018. I had a lot of trouble while gleaning information on BPC subsidy and profit/ loss. Bangladesh Economic Review, source of my BPC data, provided data on BPC profit/loss till 2009 after that it reported annual subsidy BPC received. So I delved into press reports, independent studies done by public and private think tanks. BPC website did not come to any help in this regard.

As possibility of oil price crossing $100/barrel mark in international market looms large, BPC again steps into a situation of making a huge loss. This year prior to budget a plea of Tk 8000 crore energy subsidy was made to the government. I have a conviction that any depreciation will cause the government to spend more on BPC subsidy. I also ran a VAR model using the data on crude oil spending, diesel spending, oil price, BPC profit/loss and USD-Taka exchange rate. To my dismay, I was not successful and the model did not give a better reading of the situation in the given period. Granger causality test between just BPC profit/loss and USD-Taka exchange rate yielded no causality between the two. However all the crude oil spending, diesel spending and oil price were introduced into the model later and I reran the VAR model. This time the model dropped the USD-Taka variable due to multicollinearity. Moreover the forecast graph shows during the given period the model was not good at reading the changes in oil price, crude oil spending and diesel spending.

So, I still hold the conviction that any depreciation of Taka against US Dollar will increase the spending on government subsidy to BPC. And any increase in energy subsidy will compromise the social security spending and development expenditure.

During the period the oil price fluctuated , hitting the nadir of $28.17 /barrel to reaching the apex of $111.29/barrel. Meanwhile, Taka depreciated gradually over the period.

Between 2011 and 2014, when the oil price in the international market was sold on average above $105/ barrel, BPC's annual loss also reached its peak. In this period , BPC made an annual loss of Tk 7184.25 crore on average. It made the highest loss Tk 11790 crore in 2012. To make up those losses it heavily hinged on government subsidy. According to a study by Policy Research Institute,energy subsidies reached 1.1% of GDP in 2012-2013. During the same period, its annual subsidy on average was Tk 7146.36 crore. In this period it received the highest subsidy of Tk 13557.83 crore in 2013. From 2014 onward, oil price fell below $50 / barrel and BPC made profit since then. Between 2016 and 2018, it did not receive any subsidy from the government. In addition, it reached break even stage in December 2018, as widely reported by the press. It reported a profit of Tk 5268 crore in 2015, Tk 6342 crore in 2016, Tk 4399 crore in 2017 and Tk 3995 crore in 2018. I had a lot of trouble while gleaning information on BPC subsidy and profit/ loss. Bangladesh Economic Review, source of my BPC data, provided data on BPC profit/loss till 2009 after that it reported annual subsidy BPC received. So I delved into press reports, independent studies done by public and private think tanks. BPC website did not come to any help in this regard.

As possibility of oil price crossing $100/barrel mark in international market looms large, BPC again steps into a situation of making a huge loss. This year prior to budget a plea of Tk 8000 crore energy subsidy was made to the government. I have a conviction that any depreciation will cause the government to spend more on BPC subsidy. I also ran a VAR model using the data on crude oil spending, diesel spending, oil price, BPC profit/loss and USD-Taka exchange rate. To my dismay, I was not successful and the model did not give a better reading of the situation in the given period. Granger causality test between just BPC profit/loss and USD-Taka exchange rate yielded no causality between the two. However all the crude oil spending, diesel spending and oil price were introduced into the model later and I reran the VAR model. This time the model dropped the USD-Taka variable due to multicollinearity. Moreover the forecast graph shows during the given period the model was not good at reading the changes in oil price, crude oil spending and diesel spending.

So, I still hold the conviction that any depreciation of Taka against US Dollar will increase the spending on government subsidy to BPC. And any increase in energy subsidy will compromise the social security spending and development expenditure.

No comments:

Post a Comment